Interoperability key for mobile financial inclusion – AfricaNendaInteroperability key for mobile financial inclusion – AfricaNenda

AfricaNenda Deputy CEO Sabine Mensah believes that increased interoperability in Africa's fintech sector and more policy harmonization will aid financial inclusion.

AfricaNenda is calling for increased interoperability in the fintech sector in Africa and more policy harmonization of both digital and traditional banking systems.

"There definitely needs to be more interoperability in Africa if we wanted to serve the poor, if we want to make sure that seamless transactions are happening across the continent, regardless of which service provider you are connecting with. Hopefully that will improve and it's something we are advocating for," AfricaNenda Deputy CEO Sabine Mensah told Connecting Africa in an interview.

AfricaNenda is an African-led non-profit organization that provides pre-project planning support to expand the broader pipeline of fundable, instant and inclusive payment system projects in Africa.

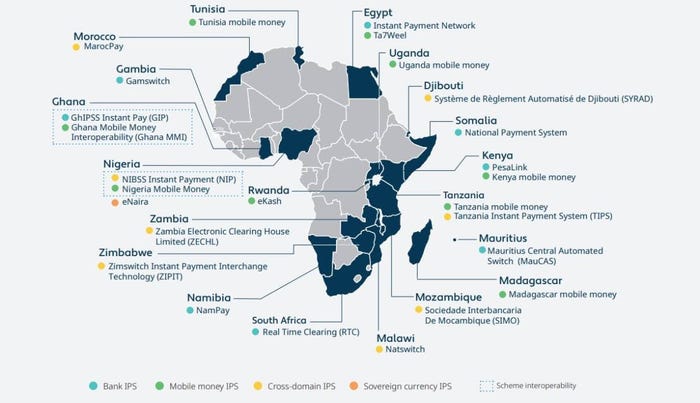

AfricaNenda's 2022 report: The State of Instant and Inclusive Payment Systems in Africa (SIIPS) mapped 29 instant payment systems (IPS) in Africa: 26 country systems and three regional systems, with three more regional systems in process.

"Out of these 29 systems only nine of them offered interoperability, so it's the minority. Although we all recognise that interoperability makes so much sense," Mensah said.

"Interoperability has benefits not only for the clients but it also has benefits for the service providers, because the pie becomes bigger than if you are in your closed loop system and only permitting transactions between your own customers. So, the pie gets bigger, for customers it's more convenient and you open the door to the fintechs," she said.

"What it means is, you only have one device and regardless of if my mother has one provider, my sister has another provider it doesn't matter. I can send and receive money and transact with each of them because these operators are interoperable on a platform at a national level or the regional level," she explained.

A lack of interoperability provides a barrier to fintech startups that want to integrate services into mobile money platforms.

"If you have three providers in the country, you have to go negotiate with each of them to have access to the network and be able to provide your services. If we have a national system that is instant and inclusive, then that system also has mandated interoperability with the players. You just connect to the system and you're able to serve everybody else. So it's a win-win," she added.

"But the challenge is some of the providers who have invested for a long time into infrastructure are not willing to share, because they've put a major investment in," Mensah explained.

(Source: The State of Instant and Inclusive Payment Systems in Africa (SIIPS) 2022 Report)

She did, however, highlight examples of where national systems have worked. In Tanzania a few years ago, three different providers came together and worked on an interoperability business case.

"Now they're all interoperable, and the impact was that for all three of them, they got a bigger pie and a bigger market to serve," she said.

The SIIPS report 2022 also highlighted the Ghana Interbank Payment and Settlement Systems (GhIPSS) which now provides interoperability between mobile money services and the banking system.

"Regardless of which device, regardless of which provider you have, you can interoperate transactions and this has contributed to increased financial inclusion in Ghana," Mensah said.

This week, AfricaNenda announced a partnership with the Prime Minister's Office of the Republic of Guinea to launch a national switch proof-of-concept based on a digital public goods platform. The pilot aims to demonstrate the interoperability of payment systems, build capacity among stakeholders, and ultimately improve access to financial services in Guinea.

AfricaNenda has also partnered with the Rwanda Information Society Agency to drive digitization efforts, which include advancing the country's merchant payment system on an open-source interoperability platform.

Policy harmonization

When it comes to fintech startups, interoperability makes it easier for them to integrate into national ecosystems but more regional integration is also needed.

"The opportunity for fintech to grow is really being able to serve different countries beyond national borders. I think that's where the ambitions of the African Continental Free Trade Area (AfCFTA) start from – opening barriers and enabling intra-Africa trade and opening the doors for fintechs to have a bigger market to serve," Mensah continued.

Intra-African trade in the digital realm comes with challenges, however. Mensah said one key issue is the need for harmonization from a policy and regulatory standpoint, another area where AfricaNenda is advocating for change.

"There isn't a harmonized fintech licensing regime in Africa. If you sign up in South Africa it's one, if you go to West Africa, let's say Senegal, it's a different one, if you go to Morocco or Egypt, it's a different one. So, for fintech to be able to tap into all these countries, you have to put in a lot of resources – legal, regulatory, system, etc.," she explained.

She believes a key ambition of the AfCFTA is harmonization of regulation from a financial perspective.

"Digital passporting, for instance, for licensing for fintech is something to be considered," she said.

Fintech license passporting in Africa could look like the framework used in the EU where if fintechs in one European country want to expand into another European nation their license is recognized, possibly with some additions, and they don't have to go through a full licensing process in every country.

However, it's not only licensing that needs harmonization but also the legal requirements for instant payments to be able to transfer across borders and meet Know Your Customer (KYC) regulation and anti-money laundering regulation, etc.

Mensah said there are many industry bodies in Africa that have already started harmonization from a regulatory perspective – specifically for KYC and anti-money laundering regulation – but that harmonizing fintech licensing still needs to be tackled.

Size of the fintech market

"Fifty years ago on the African continent, financial inclusion has always been seen through the lens of having a bank account. Today, that story has changed with the development of the mobile economy," Mensah said.

"You can be banked without necessarily having a bank account. You can leverage mobile technology, have a mobile money account, you can have a card, and you can also – through that mobile money account – save, send money, receive money and make your financial transactions," she continued.

AfricaNenda believes that if African countries institute inclusive national payment systems, that include digital payments, they will be able to offer people at the bottom of the economic pyramid the opportunity to partake in the formal financial ecosystem.

"There's an opportunity to really leverage mobile technology and leapfrog our story of financial inclusion in Africa by making sure that having an account is not defined by a physical infrastructure of the bank," Mensah said.

AfricaNenda estimated that in 2021, about 16 billion instant payment transactions were made in Africa, which came close to $1 trillion in value in the ecosystem, which is probably an underestimate.

However, even with the growth in mobile financial services in Africa, the World Bank's Findex data for 2021 estimates that there are still around 350 million adults on the continent who are financially excluded – who do not have a bank account or mobile money account.

Advocating for inclusive payment systems

The AfricaNenda team contains African specialists with experience in payments, mobile money, financial inclusion and economic development. Mensah herself worked in the remittance industry for 15 years and then worked with the UN on digital economy and financial inclusion.

"Our sole focus is really to see how we can work with different stakeholders in Africa – these could be central banks, government agencies, private sector associations, or other enablers in the development ecosystem to develop and scale up what we call 'instant and inclusive payment systems' at a national level or at a regional level," she explained.

The non-profit provides project support, capacity building and advocacy for policymakers to make data-driven policy decisions in favor of financial inclusion.

"We want to enable everybody in Africa to make digital transactions seamlessly and at a low cost wherever they are on the continent by 2030," the group's mission statement reads.

Regulation lags behind innovation

"The velocity of change in the fintech industry and in financial technology is just amazing. This gives me so much hope for us to be able to solve financial inclusion challenges that we see in the world, there's no doubt about it," Mensah said.

The success of fintech companies in Africa has been widely documented, with some reaching unicorn status already. Mensah believes that to some extent policy is still lagging innovation, but that change is happening.

"What I've seen is actually a change of mindset from our policymakers and regulators and several countries have instituted sandboxes," she said.

"The whole idea of a regulatory sandbox is to enable these innovators to come to the country and demonstrate the business case, demonstrate their processes. Then the regulator can observe how this is working and provide guidance in terms of consumer protection, risk mitigation, and governance for the fintechs – to make sure that they're really bringing up this innovation within a context that reassures the regulator that this will indeed protect consumers," Mensah added.

She highlighted countries like Kenya that are instituting digital sandbox initiatives.

AfricaNenda Deputy CEO Sabine Mensah believes there has been a change of mindset from African policymakers who are now more focused on incentivizing innovation. (Source: Freepik)

"I've seen more and more openness from regulators in Africa to really incentivize innovation in the ecosystem. But the main mandate remains, which is maintaining the stability of the financial ecosystem and protecting consumers," she said.

"So, there is a dichotomy of needs between wanting to push innovation and at the same time, providing a safe environment, which makes it sound like it's not going as fast as we would want to."

Data-driven decisions

AfricaNenda will publish its next SIIPS report for 2023 in November, but Mensah admitted that gathering accurate and inclusive data on payments in Africa is still challenging.

"We've reached out directly to central banks and switch operators and asked for the information. We have received a few, but it's still not the full picture. But this is an advocacy that we will continue. We hope to be able to bring more data on the state of instant payment in Africa and how this is moving in terms of providing more options for financial inclusion," she said.

One of the biggest challenges is that most financial data is not disaggregated by gender. This makes it hard to define the true financial gender gap.

"Mandating gender disaggregated data for the financial and digital ecosystem would be one way for policymakers and the rest of us to understand how deep these gaps really are, based on data," she concluded.

Related posts:

— Paula Gilbert, Editor, Connecting Africa

_(1).jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

_(1).jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=800&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)