AI's impact on African telcosAI's impact on African telcos

Many African telecommunications companies are turning to artificial intelligence as a differentiator to improve their mobile networks and enhance customer service and experience as they transition from traditional telco offerings into new tech-first verticals.

The value of the African telecommunications market will grow from US$63.17 billion in 2024 to over US$82.34 billion by 2029, according to research from Mordor Intelligence.

The region's telecommunications companies are targeting high growth and customer loyalty in markets grappling with weakened consumer purchasing power and strong competition, with many turning to artificial intelligence (AI) as a differentiator.

The discussion now centers around the extent to which AI technologies – encompassing machine learning, deep learning and natural language processing – can help with African challenges like the digital divide, low levels of financial inclusion and customer usage of data and digital services.

Toward an AI-powered telecom sector

Artificial intelligence is growing in prominence on the continent as various industries leverage digital transformation for growth.

The United Nations Economic Commission for Africa estimates that AI could inject US$1.5 trillion into the African economy by 2030.

Derrick Chikanga, research manager for IT services at the International Data Corporation (IDC), notes that the adoption of AI solutions in Africa is still at an early stage as stakeholders in most sectors are currently assessing their business needs.

This is a necessary first step for the telecom sector. Many operators are transitioning from traditional offerings into new verticals such as fintech and media services, so they require an understanding of the value of AI for these respective business lines before investing significantly in the technology.

At present, the emerging use cases mainly focus on customer interaction as well as cost and efficiency of operations and anticipating market trends.

"The low hanging fruit that almost everyone is considering is enhancing customer service or experience. This is where companies feel AI could make an immediate impact," Chikanga says.

In recent years, Africa's most prominent mobile network operators have engaged with AI technologies to different degrees.

This has ranged from Ericsson and Telecom Egypt's partnership to deploy AI on the latter's cloud infrastructure to MTN's launch of an AI strategy centered on integrating the technology into its applications and features, digital assistants, automation and machine learning technology. MTN also launched its pilot internal AI solution, "SiYa," an employee chatbot, in December 2023.

Chikanga cautions, however, that it may be too early to make quantitative predications regarding African telcos' AI adoption.

However, he points to an IDC survey of relevant firms in South Africa that found that approximately 16% of respondents had deployed AI solutions by October 2023. Over 50% were either considering, or would consider, deploying them within two years.

This indicates that the pace of AI adoption in the African telecoms sector has been gradual to begin with, and that the initial investment in AI may not be significant while use-cases remain in the proof-of-concept phase.

African AI market attractive to global players

Global technology vendors are also intensifying their focus on the continent, as they vie for a share of the African market's AI demand.

Chikanga highlights providers such as Microsoft's Copilot, Amazon Web Services' (AWS') Lake Formation, Gemini Pro by Google and Cisco's Motific as ones to watch in the space.

"Cloud providers like AWS and Microsoft Azure could play a key role as they already have cloud platforms (Platform-as-a-Service) from which to provide AI tools to enterprises," he added.

Home-grown innovators are also asserting themselves in the market. Wihan Booyse is the director of artificial intelligence at Kriterion, a South Africa-based provider of AI-powered performance management solutions for digital assets. Kriterion's solutions are currently installed on 15,500 telco tower assets across, Kenya, Nigeria, Niger, Uganda and Burkina Faso. It assists in the maintenance of distributed power for micro grids, telecommunications, mobile plant industries and mission-critical backup systems.

Notably, Booyse touts Kriterion's ability to support telcos' transitions toward a fully green network infrastructure. He notes maintenance and fuel savings predictions have reduced CO2 emissions, on the managed sites, by 14 kilotons per year.

"This is enough to completely offset the CO2 emissions of 30,000 Africans each and every year," he stated.

Barriers to AI adoption

Africa's technological development has long been hampered by a deficit of high-speed, digital network infrastructure. This has led to a disparity across the continent, largely along urban and rural lines. Coupled with low electricity penetration on the continent, this could threaten the widespread adoption and utility of AI in the region.

To that end, it is positive that the region is benefiting from increased investment into long-haul, middle-mile and last-mile connectivity from sources ranging from telecom service providers themselves to global institutions such as the World Bank, as well as individual nations – but far more is required to improve connectivity and drive up usage.

"AI, as advanced as it may be, is still a digital technology, and like other digital technologies, its reach and accessibility are contingent on bringing more people and data online. You need to bridge the digital divide to enjoy the dividends of AI, not the other way around," ICT lawyer Akin Agunbiade cautioned.

Regarding the region's power challenges, Booyse argues that AI can actually assist telcos in managing and optimizing their use of energy as they contend with strained national power grids. He noted the impact that Kriterion has had in reducing downtime at its sites by 30% per year.

"When the Nigerian power grid collapsed last year, and the Power Holding Company of Nigeria was only providing 250 MW. Kriterion-monitored sites in Nigeria were doing 450 MW," he added.

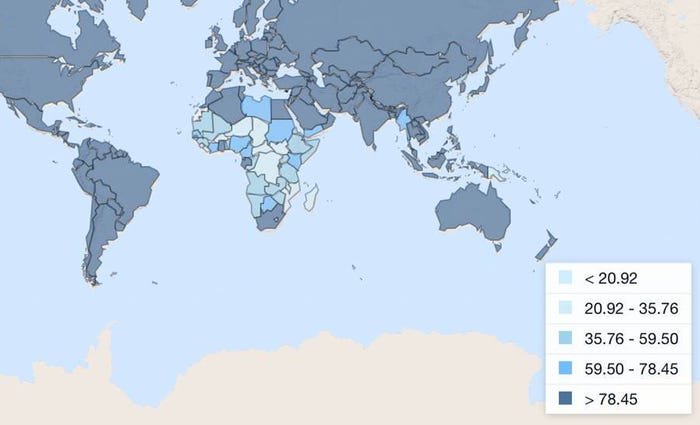

Sub-Saharan Africa access to electricity (% of population). (Source: World Bank)

The skills gap also poses challenges for the adoption of AI. To that end, some of the region’s telcos are already looking to build internal capacity to ensure sustainability and scaling up their innovations.

For example, in April 2023, Vodafone partnered with Lancaster University Ghana, on an eight-week AI training program for 21 of the telco's executives.

MTN and Axian Telecom have also introduced training programs, for students, in practical science, technology, engineering, mathematics, and science-related courses relevant to the telcos' operations.

Transparency, data security, and privacy risks abound

Data protection and privacy issues remain at the forefront as the telecom sector collects large amounts of sensitive data from clients including contact information, identity and even financial information.

Operators engaging with AI face more risks, particularly in markets where regulators are yet to adequately engage with the technology, meaning that innovation is outpacing AI policy guidelines and regulation to prevent harm.

Mauritius was the first African country to adopt a national AI strategy in 2018, and it is positive that more African governments are developing AI policies and guidelines for the safe and ethical adoption of the technology that are fit for the African context.

Countries such as Egypt, Rwanda and Senegal have since also introduced national AI strategies to drive the digitalization of their domestic industries. Ethiopia and Nigeria, too, are developing AI strategies.

To harmonize and unify the continent's approach, in 2022 the African Union began working on its Artificial Intelligence Continental Strategy for Africa. This is expected to be released in early 2024.

"This roadmap is expected to provide a comprehensive strategy for supporting inclusive and sustainable AI-enabled socio-economic transformation," Agunbiade explained.

However, he notes that, as AI is a costly technology to deploy, countries should adopt a market-based approach to delivering benefits by ranking AI priorities based on their national comparative advantages and most active GDP sectors.

African operators are engaging with AI technologies to different degrees, to better understand the value of AI for specific business lines. (Source: Image by freepik)

Agunbiade also advocates for the employ of sandboxes where telecom operators and value-added service providers can test AI solutions, with these insights then guiding the development of tailored guidelines and licensing agreements.

Meanwhile, the strides made by governments in the development of data protection policies and digitalization processes can provide some guidance for the early-stage engagement with AI technologies, while industries await specific AI standards.

Chikanga also flags that the adoption of AI in the telecom sector may render it even more attractive for cyberattacks, with criminals capitalizing on the increased use of AI-powered chatbots, for example, to attack telecom operators.

"Outside traditional finance, telecom companies probably sit on the largest trove of behavioral and financial data," Agunbiade added.

In February 2024, cybersecurity firm Kaspersky warned that attacks are becoming more "diverse and sophisticated," with phishing, ransomware attacks, backdoors and exploits in African countries.

Booyse meanwhile is of the view that AI can also help fortify telecom infrastructure. For example, AI solutions can be programmed to immediately detect when systems have been infiltrated and automatically restore parameters to the desired versions to prevent a network from being taken down.

"This is the beauty of artificial intelligence for IT operations," Booyse argued.

Positive long-term outlook for AI

The African telecommunications industry has long been at the forefront of market disruption so, as the AI landscape evolves, the sector looks set to benefit greatly. This will be aided by innovation both from global and local players, improving policy and regulation and increased investment in digital infrastructure.

Although the industry will still move cautiously and a compelling business case and clear path to return on investment will be necessary before a widespread adoption, it appears AI is here to stay.

"There are skeptics who believe that we shouldn't be talking about AI when we haven't solved other fundamental issues. They have a point, but the truth is, if we fail to prepare for AI, we will wake up one day completely irrelevant and disconnected from an automated future," Agunbiade concluded.

Related posts:

*Top image source: Image by rawpixel.com on Freepik.

— Chiti Mbizule Mutati, correspondent, special to Connecting Africa

.jpg?width=700&auto=webp&quality=80&disable=upscale)

_(1).jpg?width=700&auto=webp&quality=80&disable=upscale)

_(1).jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

_(1).jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)