African Mobile Capital Expenditure Makes a Fragile RecoveryAfrican Mobile Capital Expenditure Makes a Fragile Recovery

The year-on-year decline in Africa mobile operator capex has halted but network equipment vendors shouldn't get too excited just yet.

May 8, 2017

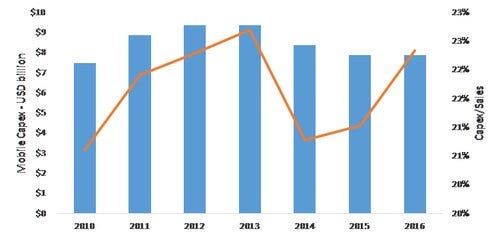

Data from the Xalam Analytics Africa Mobile Operator Dashboard shows that, following three years of consecutive decline, African mobile capital expenditure stabilized in 2016, staying flat at around US$8 billion.

While not quite a rebound, the improvement indicates that mobile operators are slowly plowing money back into capital investments (networks, supporting systems and spectrum licenses).

Of the eight pan-African operator groups analyzed as part of Xalam's Capex Index, five showed a marked increase in capital expenditure in 2016 - by 15-20% in some cases. For the most part, capex actually increased in local currency terms, only to be pegged back by sharp currency depreciation. Capital intensity (the percentage of revenues assigned to capex) even increased slightly, from 21% of sales to 22% as operators increased spending despite decline in their top line revenue when measured in US dollars.

It is quite notable that capex intensity has continued its rebound, even as top line revenue has continued to decline.

Sources: The companies, Xalam Analytics Research Estimates based primarily on Xalam pan-African Mobile Index, including mobile capex by main pan-African players – MTN Group, Orange Group, Vodafone affiliates (incl. Vodacom, Safaricom, Egypt), Airtel Africa, Millicom Africa, Etisalat (incl. Maroc Telecom), Ooredoo and Sudatel.

There are material variations by country; South Africa, Egypt and Morocco are recovering, mostly driven by accelerated 4G investments and spectrum acquisition. The Nigerian market, by contrast, remains in the doldrums: capex there has declined by an average of around 20% during the past four years, with 2016 mobile operator capital expenditures at only around 40% of 2012 levels.

There are also critical differences by operator. MTN Group Ltd. , which spends more than any other operator in Africa, increased its spend in US dollar terms by about 3% in 2016, as did Orange (NYSE: FTE)'s African operations.

MTN has indicated that it will increase its capital spend, which totaled 34.92 billion South African Rand ($2.58 billion) last year, further in 2017.

By contrast, Airtel Africa - the African operations of Bharti Airtel Ltd. - and Millicom Africa were responsible for the sharpest cuts in capital spend - slightly more than 30% in both cases - in another sign that the two groups are gradually narrowing their scope and refocusing their African businesses. (See Data Uptake Drives Return to Growth for Airtel Africa and Millicom Africa Exit on the Cards After Positive 2016.)

The African mobile infrastructure transition towards more "cloudified," virtualized platforms has started slowly, with operator focus remaining on basic connectivity. Outside of spectrum acquisition, the large majority of capital spend is going to urban area capacity build, 4G deployments, metro fiber and the upgrade of IT systems.

Despite the top line improvements, some underlying weaknesses remain. For one, the top line numbers are slightly inflated by 4G spectrum acquisition, notably in Egypt. Excluding spectrum acquisition, we estimate that top line African mobile capex actually fell by around 10%.

Some of the fundamentals that have led to the previous declines in capex persist: Consolidation has reduced the discrete number of high-capex players; uncertainty hovers over the African mobile business model; and under current revenue and margin trajectory, $1 invested today will return less than half of what it did in 2010.

Further, the investment outlook is largely indecipherable in many markets, due to a number of factors including lack of 4G spectrum, increased tax pressure and uncertain regulation. In turn, operators are holding back, only doing what is strictly necessary until they have better visibility.

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

_(1).jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=800&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)