MTN & Vodacom Hit Back at Data Pricing Report

MTN and Vodacom continue to blame high data prices on a lack of spectrum.

South African mobile operators Vodacom and MTN are less than delighted with a recent report from the Competition Commission which found that the operators' data prices are excessive in their home market.

This week the Commission published the final report from its Data Services Market Inquiry, along with recommendations for sweeping changes to South Africa's data pricing, singling out MTN and Vodacom for excessive charges.

Amongst the long list of recommendations was that MTN and Vodacom need to drop their data prices immediately "in the region of 30% to 50%" within two months, or face prosecution. All operators also need to provide their prepaid subscribers with a "lifeline package" of daily free data "to ensure all citizens have data access on a continual basis, regardless of income levels". (See SA Competition Commission Forcing MTN & Vodacom to Cut Data Prices and Free Data for All: SA Competition Watchdog.)

The Commission believes that SA's data prices are "anti-poor" and that retail price structures lacked transparency.

Spectrum, spectrum, spectrum

MTN continued to blame high data prices on what it called a "suffocating lack of spectrum," adding that "to simply lay the blame for data costs at the foot of the operators is wrong."

"For more than a decade, government and regulators have failed to release the spectrum that the mobile industry has so critically required to bring down the cost to communicate," MTN said in a statement. "MTN in South Africa has had to compensate for the lack of spectrum by spending over R50 billion in the last five years to build a world-class network for all South Africans, covering over 95% of the population with 4G coverage, without any 4G spectrum having been allocated."

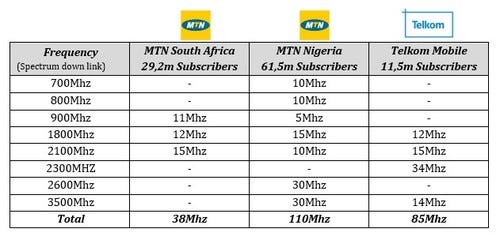

"A comparison across the continent is helpful in illustrating this point. Nigeria is often cited as an example of a developing country with lower data costs than South Africa. In South Africa, MTN has just 38MHz of spectrum. MTN Nigeria has almost triple that, with 110MHz," MTN added.

MTN's Spectrum Allocation Comparison

"Vodacom has consistently stated that delayed spectrum allocation has impacted the rate at which data prices could have fallen. Vodacom has reduced the effective price of data by circa 50% since March 2016," Vodacom spokesperson Byron Kennedy told Connecting Africa via email.

Both MTN and Vodacom did not directly comment on the demand from the Commission for an immediate price drop. MTN said it still needs to study the full report and was not yet able to comment on the details of the report. Vodacom similarly said it was currently reviewing the document and "will engage with the Commissioner on the matters that arose in the report and will comment further in due course".

Difference of opinion

Vodacom, however, was quick to point out the "significant difference" in opinion between the Competition Commission and the Independent Communications Authority of South Africa (ICASA) "on a number of issues that are critical to data prices in South Africa."

This as ICASA last Friday also published a discussion document on the Market Inquiry into mobile broadband services in South Africa.

According to Vodacom's Kennedy, ICASA concludes from its analysis of international mobile data prices that "South Africa's prices are neither extremely high nor very low in relation to other African countries or compared to countries which are more similar to South Africa in terms of their size and level of development. When put in further context with data on speeds and LTE coverage, it is clear that customers in South Africa are benefiting from a much higher quality of access than those in other African countries."

On the other hand, the Competition Commission states: "South Africa currently performs poorly relative to other countries with prices generally on the more expensive end."

Spectrum delays are another issue of contention, according to Vodacom, as "ICASA says there are 'a number of reasons why spectrum assignment is critical to achieving cheap, high quality mobile broadband,' whereas the Competition Commission has downplayed the role of spectrum in reducing data prices."

South Africa's mobile operators have been waiting for many years for high-demand radio frequency spectrum to be released by the government. Telcos have until now been forced to refarm 2G and 3G spectrum to provide 4G services, while plans for 5G have almost remained theoretical without access to the correct spectrum.

This looks set to change soon as ICASA in November finally published an Information Memorandum outlining its plans for the licensing process for spectrum for both 4G and 5G services. (See SA Spectrum Licensing: What You Need to Know.)

MTN says that a "suffocating lack of spectrum" is making it hard to drop data prices.

Challengers smiling

The Commission accused Vodacom and MTN of price discrimination strategies "that may facilitate greater exploitation of market power and anti-poor pricing."

The criticism of MTN and Vodacom was received well by Telkom which told Connecting Africa it "is pleased that the data market enquiry has affirmed the view that the South African market is a duopoly with no effective competition."

"Price is the effect of a market structure. The Competition Commission must interrogate the structure of the market and review all the components that give effect to current data prices," Telkom said.

"We are also pleased that the Competition Commission has committed to giving attention to the process of licensing spectrum. We have seen the consolidation of spectrum recently. This influences market structure. Spectrum sharing agreements need to be reviewed to ensure they support market competition," it added.

Telkom, however, did not respond to Connecting Africa's questions about the Commission's ruling that its wholesale division, Openserve, must substantially reduce the price of IP Connect "to remove excessive pricing concerns" within the next two months.

Cell C was the only operator not given an individual recommendation by the Commission and its response to the report was muted.

"An industry that promotes sustainable investment, effective competition and affordable services to consumers is a win for all. Cell C recognises that lower data costs are a catalyst for economic growth and therefore welcome steps taken to bring down the cost of data," it said via email.

"Against this background, we are reviewing the findings of the Competition Commission in the Data Market Inquiry and will provide more detailed comment once we have completed our review," Cell C added.

_(1).jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)